JWP GOLDEN FUND

Portugal is known as the paradise of Europe's Iberian Peninsula, and when international investors have not yet discovered the potential of Portuguese investment, the JWP team has preemptively entered the blue ocean market of Portuguese real estate in 2011 and tapped the first pot of gold for real estate investment. Two years later, the business expanded and a local Portuguese branch was established. After the Portuguese AIMA enacted a new policy that fund investments can apply for a golden residence permit,The JWP Fund team designed and developed the JWP Portugal Fund in accordance with the regulatory requirements of the Portuguese Securities Market Commission (CMVM) and the European Central Bank (ECB). The fund is a closed-end private equity fund that invests in potential commercial companies in Portugal. Fund advantages: not only provides diversified asset allocation services for high-net-worth individuals, but also helps investors successfully obtain EU status. The fund investment strategy is deeply researched by our senior financial team, focusing on core assets in core areas, with value-added attributes and stable returns, crossing investment cycles, resisting inflation risks, and achieving a win-win situation for investment and identity.

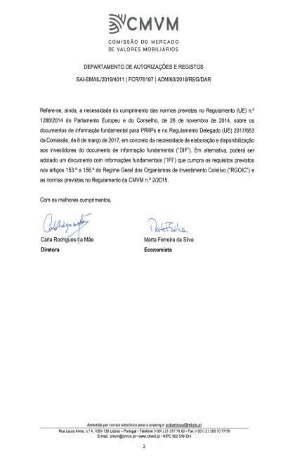

Fund Certificate issued by CMVM

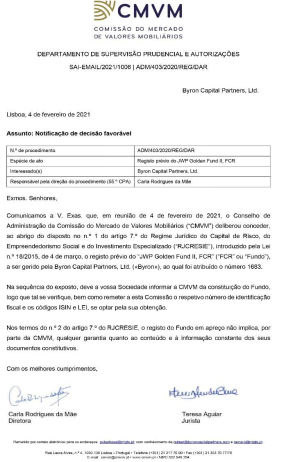

Fund Investment Act

Act No. 56/2023 of October 7, 2023

The "golden visa" in Portugal has officially abolished the investment categories of 1.5 million euros in deposits, 500,000 euros in house purchases, and 280,000/350,000 euros in renovated properties. The new law allows investment of no less than 500,000 euros in funds established in Portugal for the acquisition of some non real estate collective investment enterprises , and requires the fund to invest at least 60% in commercial companies headquartered in Portugal, with an investment period of at least 5 years.

Act No. 14/2021 of February 12, 2021

The Residence Permits for Investment Activities' region (ARI) has been revised. Effective from January 1, 2022: The minimum investment requirement for fund options has been adjusted from 350,000 euros to 500,000 euros.

Act No. 102/2017, which came into force on 26 November 2017

Allowing non EU citizens to obtain Portuguese "golden visa" through capital transfer investment. Non EU citizens who apply for gold visa under this law should invest at least 350,000 euros to purchase a company's capitalized investment fund or venture capital fund. Its investment period is at least five years, and at least 60% of the investment is realized through commercial companies headquartered in Portugal.

Why choose JWP Golden Fund

While most international investors have yet to discover the potential of Portugal, the Iberian pearl, JWP has benefited from encouraging real estate investment results since 2011 and established a subsidiary in 2013. In response to the latest Portuguese Golden Visa programme, JWP has announced the establishment of the JWP Golden Fund, regulated by the Portuguese Securities Market Commission (CMVM) and the European Central Bank (ECB).

The fund is a closed-end private equity fund dedicated to capitalizing Portugal-based companies, offering high net worth individuals an attractive portfolio of investments and Portuguese residency.

Competent financial experts and dedicated research analysts have developed JWP Golden Fund's primary investment strategy focused on uncovering unrealized growth opportunities and hidden value in a booming tourism market.

Fund Elements

Fund Investment Strategy-Real Estate Investment Fund

Fund investment direction

Enterprises with high growth, development, appreciation, and profitability in the market they operate in;

investment strategies

administrative services related to tourism, hotel management, service apartments, joint office spaces, logistics, etc;

Unleveraged

100% of the fund's own funds:

Risk diversification

Adhere to diversified allocation, control the investment amount of individuaprojects, choose medium scale projects, diversify types and regions, reduce the selling risk duringexit. and enhance risk resistance;

Strong asset liquidity

Compared to individual investors, funds mainly choose popular areas andimited supply of essentia projects that are popular among institutional investors to invest inensuring liquidity upon exit;

Clear exit path

The team has already started planning the exit path in the early stages of investment, establishing a database of potential buyers, and identifying future buyers for individual projects to lock in profits in advance;

Clear exit time

The fund product has a fixed cycle and a clear return time for funds, which facilitates the team to plan in advance and ensure sufficient cash flow of the fund at the end of the closure period. lnvestors do not need to worry about not being able to recover investment funds;

Acquisition

Core Assets

High quality assets in core cities, core locations, and core investment areas

Upgrade

Integration and optimization

Through asset and service integration, bring new added value to assets

Operations

Stable returns

Deterministic returns and stronger risk resistance brought by mature assets

JWP Golden Fund’s advantages

The investment cost is low, and the fees are clear and transparent; the products are standardized, the investment amount can meet the fund share, and the fund has no taxes and additional maintenance costs;

Safe and worry-free, strong supervision; the fund is supervised by the Portuguese Securities Regulatory Commission, the Portuguese Central Bank, and the European Central Bank, and the funds are supervised by professional depositary banks to ensure the safety of funds;

Diversified investment allocation to effectively diversify risks; invest in commerical operation company , reduce restrictions on a single project and a single region, and improve the ability to resist risks;

The investment and research system is sound and managed by a professional team; through in-depth research on Related policies and local market research, make more professional judgments for investment;

No leverage to maximize the security of the principal; all investment activities of the fund only use its own funds, and the investor is the only holder of the asset.

Invested Projects

- Located in the old town of Lisbon

- Assets worth approximately EUR 4 million

- All sold out

- Located in the old town of Lisbon

- Assets worth approximately EUR 4 million

- All sold out

- Located in the old town of Lisbon

- Assets worth approximately EUR 4 million

- Sold out within a week

- Located in the old town of Lisbon

- Assets worth approximately EUR 6 million

- All sold out

- Located in Oeirache, Lisbon

- Located in the core tourist area of Portugal

- 3 floors, a total of 6 European-style apartments

- The value of the assets is approximately euro 3 million

- Acquired

- Brand new 4 star hotel in the heart of Porto

- Assets worth over ten million euros

- Number of rooms: 80

- Management of international chain operators, signed a 15-year long-term contract

- Located in the core area of Liberdade, Lisbon

- Asset value exceeding 10 million euros

- Covering an area of 2352 square meters

- Rare locations, high-quality tenants

- High long-term lease with zero vacancy rate

- Located in the old city center of Lisbon's political and business district

- A hotel with an area of 2500 square meters, 53 rooms, and a value-added four-star rating of millions of euros -Adjacent to Liberdade in Lisbon, one-stop shopping, consumption, leisure and tourism

- The demand for hotels is extremely high, with long-term leases and professional operator management to ensure stable revenue

- Renovation in progress, expected completion date 2025